Ghana Launches Landmark Domestic Infrastructure Bond to Power Economic Revival

Ghana is set to issue its first-ever domestic infrastructure bond, targeting ₵10 billion (approximately $935 million) to fund critical road networks and interchanges nationwide. The issuance will be structured in two tranches of ₵5 billion each, scheduled for the first and second halves of 2026, featuring longer-dated maturities. An official issuance calendar, including details on this and other domestic bonds, is expected later this month.

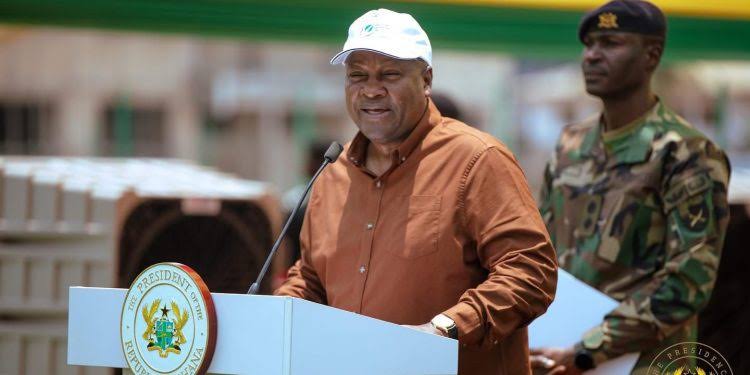

This pioneering move aligns with President John Dramama Mahama’s Big Push initiative, an ambitious program aiming to mobilize up to $10 billion for transformative infrastructure projects to drive job creation, economic growth, and national development. The government has significantly ramped up funding in the 2026 budget, allocating ₵30 billion — more than double the ₵13.8 billion budgeted in the previous year — to support these priorities.

A key feature of the infrastructure bond is its self-financing design, with projects primarily funded through revenues such as electronic road tolls. This approach is intended to minimize additions to the national debt burden, reflecting prudent fiscal management amid ongoing recovery efforts.

The initiative comes as Ghana demonstrates strong macroeconomic progress following its 2022 debt default and the subsequent $3 billion IMF Extended Credit Facility program. The country is on track to successfully exit the IMF bailout in May 2026, with notable achievements including:

– Inflation reaching a historic 23-year low of 5.4% in December 2025 (down from nearly 54% in 2023 and 6.3% in November 2025), marking 12 consecutive months of decline. Food inflation eased to 4.9%, while non-food inflation moderated to 5.8%.

– The Ghanaian cedi delivering an unprecedented 41% appreciation against the US dollar in 2025 — its first annual gain in over 30 years — bolstered by strong gold exports and improved reserves.

– Yields on long-term cedi bonds (e.g., due 2039) falling sharply by over *0 percentage points in the past year to around 16%, signaling restored investor confidence.

The International Monetary Fund has welcomed efforts to deepen domestic capital markets but emphasized the need for prudent sequencing to avoid crowding out private credit and to maintain debt sustainability. An IMF spokesperson noted that, if well-designed and focused on high-return projects, such infrastructure bonds can effectively support growth, job creation, and private-sector activity.

As Africa’s largest gold producer continues its turnaround, this debut infrastructure bond represents a strategic step toward sustainable financing of development priorities while reinforcing fiscal responsibility and market confidence.